Past, Present, and Trends

Who are we?

• Oldest commodity reporting company in the U.S.

• Reporting the commodity market since 1848

• Started with a printing company

– Manhattan New York, NY

– Market canvass

So, what do we do, and how do we do it?

• Market Canvass through

– Reporters and Analysts gathering:

• Quantitative data

• Qualitative data

• Arrive at quote that represents the bulk of trading

• Brings transparency to the market

• Therefore, brings efficiency

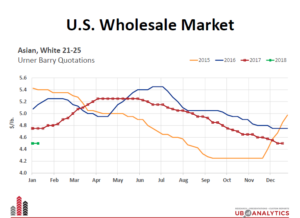

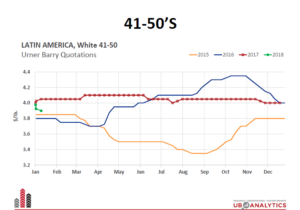

Specifics on Prices

• Spot market prices

– LTL trades (avg. 2,000-3,000 lbs. Per trade, ex. Salmon and other items specified)

– Different FOB points

» Ports

» Cities

» Regions

• Only sales, bids and offers for cash terms are accepted for consideration.

• No distressed product, or product offered or bought under distressed conditions, is acceptable.

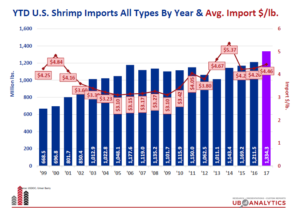

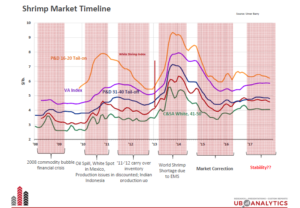

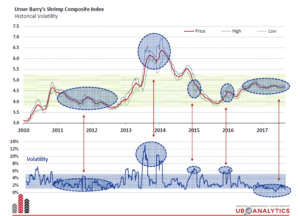

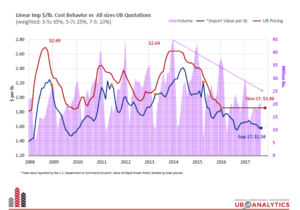

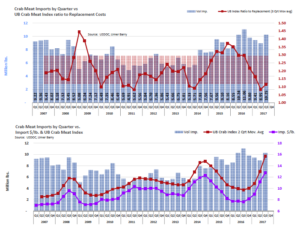

To understand where we are… we must go back to 2013

4 Events take place:

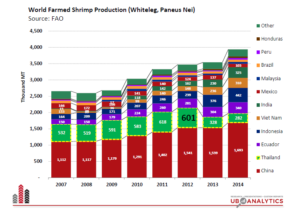

• #1 Shrimp Supplier (not producer) loses over 45% of their production

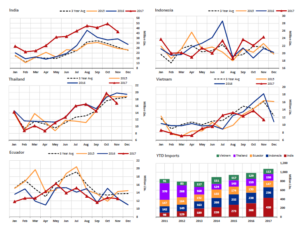

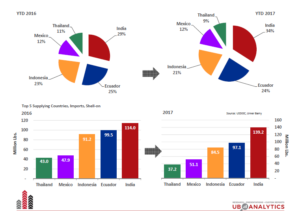

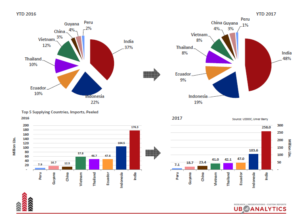

• 3 major producers expand their production during this supply shock (India, Indonesia, Ecuador)

• China’s production, allegedly remains flat

• Chinese demand increases rapidly

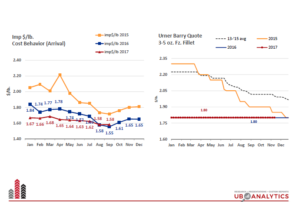

• Upward Price pressure in Q1; summer spike

– Market prices firm into Q2

– Slope of upward trend turns steep

• Seasonal imports take a dip

• Emerging markets enter the market place; China

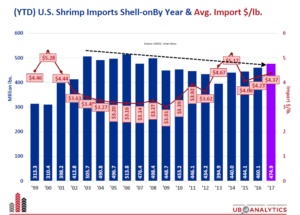

• Implosion of EMS

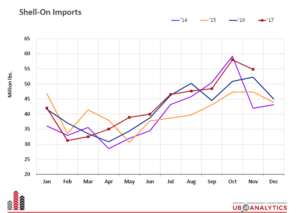

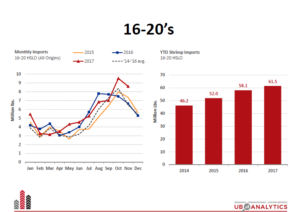

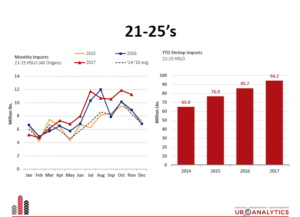

Shell-on (Headless) HSLO Shrimp

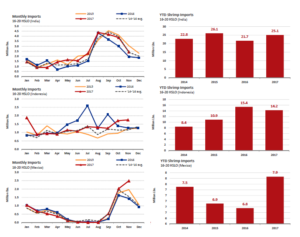

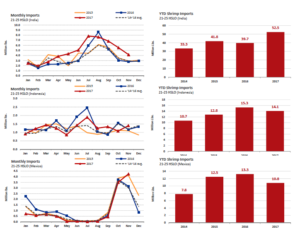

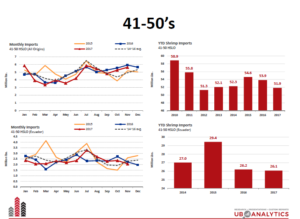

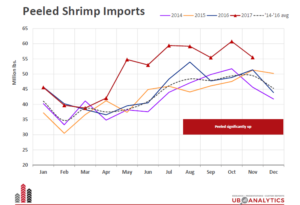

Peeled Shrimp

Shrimp Conclusions

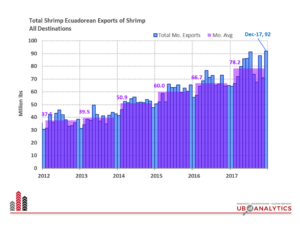

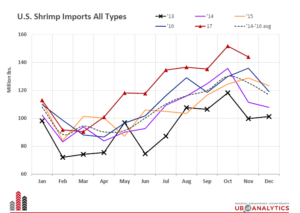

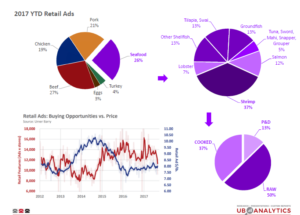

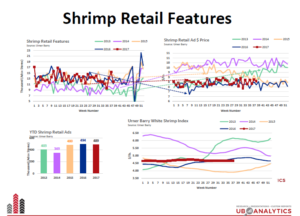

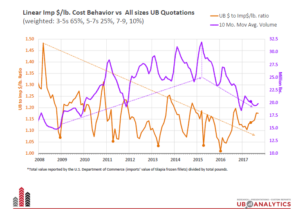

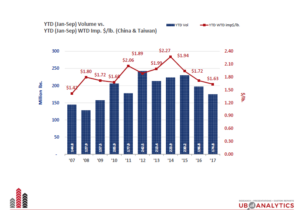

• Imports highly seasonal

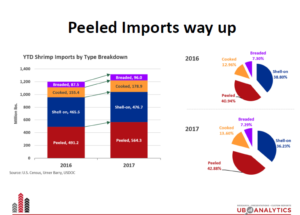

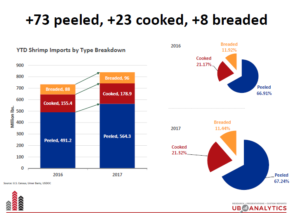

• Transition from HSLO, to value-added

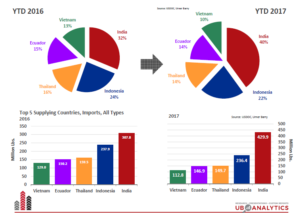

• India main supplier of all types

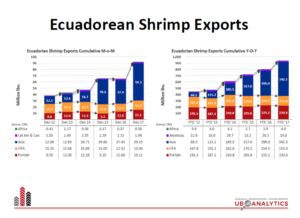

• Ecuador shipping most of its volume to China

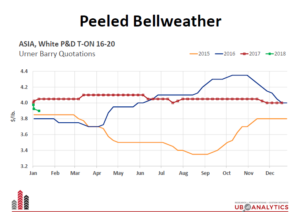

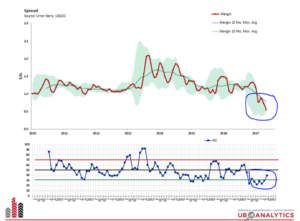

• After price crash (ems) market is very steady

• Wholesale mkt vs. Retail ads & Price

Source: Society of Aquaculture Professionals (SAP)